I have long been of the view that the current basis of assessing payments for charities when they exit an LGPS is excessive and doesn’t provide a fair balance between the schemes and the charities. Indeed I’m not the only one to hold this view.

In 2015 the Scheme Advisory Board in England & Wales commissioned research from PWC on this specific issue which commented:-

“We recommend that Funds should not be permitted to use very onerous assumptions for exit bases. One way to achieve this would be to require that the discount rate applied should not be stronger than CPI plus 1.0% or plus 1.5%. This would be the maximum strength exit basis. The range suggested is consistent with cautious investment policies but not zero risk investment policies.”

Needless to say this view represented ‘an inconvenient truth’ for LGPS Funds so the recommendation was just completely ignored. Its likely that this approach may have needlessly cost the UK’s charity sector many £100’s of millions. So just how much have Funds, and indeed their sponsoring local authorities, benefitted from these payments?

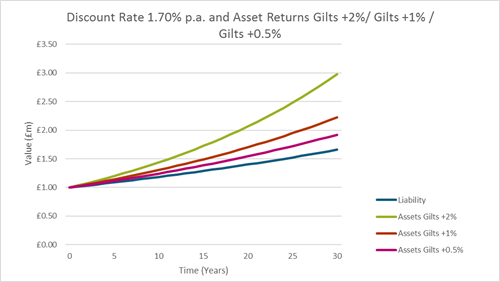

If we use a simple example comparing returns and gilt yields to highlight the issue (i.e. at this stage we are assuming all other factors remain constant). We have cessation assets and liabilities of £1m at outset with estimated on-going liabilities of £670,000 based on a 67% cessation funding rate. Table 1 shows the potential return based upon a gilts-based discount rate of 1.7% and returns of 0.5%, 1.0% and 2.0% above gilt yield (the latter reflecting broadly the on-going funding assumption).

The table shows that a matching gilts-based liability would have increased to £1.4m after 20 years and £1.66m after 30 years. Over 20 years the equivalent asset value covering this at 0.5%, 1.0% and 2.0% above gilts would be £1.55m, £1.70m and £2.07m respectively. So effectively the Fund (i.e. other active employers – primarily the Council) would have benefitted from the cessation payment by anywhere between £150,000 (11%) to £670,000 (48%) over this period based on these assumptions.

The equivalent ‘on-going’ liability reflecting a 2% return above gilts would have been around £670,000 so the exiting employer would have been paying a cessation ‘premium’ of £330,000. Allowing for a discount rate of 1.0% and 0.5% above gilts this cessation payment would reduce by £180,000 and £90,000 respectively while still providing a reasonable security margin for the Fund.

However, the position is in reality much worse than the example as the actual returns achieved by the Funds over the last decade or so have been hugely in excess of those assumed. If we consider an employer exiting in 2008 using the actual average return disclosed in the LGPS SAB Annual Reports across all Funds (net of charges) and the actual prevailing gilt yields the picture is alarming.

Based upon the £1m starting point the actual return from April 2007 to March 2018 was 87.7% (average 7.97% p.a.) and the gilts return over the same period was 35.75% (average 3.25% p.a.). This means that the actual gilt value of the £1m liability would now be around £1.42m however the actual value of the assets would be nearly £2.3m. So the Fund will have made nearly £900,000 excess return over gilts on the £1m of assets over only 11 years and around £1.3m in total. Even with no cessation payment the assumed on-going asset value (£670,000) would by 2018 be in excess of £1.5m and therefore over the gilts-based value and well in excess of a likely ‘on-going’ value which would be around £1.2m.

Funds are therefore collecting huge and, in our view, unreasonable payments on exit well in excess of the amount of money actually needed to provide the benefits. We do not question the need for some form of prudence margin to be applicable for exiting employers but Funds are demonstrating excessive prudence and refusing to consider change because they have the power not to do so. It is not unreasonable to assume that Funds could easily have taken £100’s of millions in cessation debts from the charitable sector over the last decade or so and benefitted by additional multiples of that figure. Is it reasonable for public bodies to effectively ask our charitable organisations to cross subsidise their costs to that extent?

We are firmly of the view that the existing approach is flawed and in need of revision and we made some proposals how this could be addressed in our submission to the Consultation on LGPS in England & Wales though would be less than confident that the turkeys will vote for Christmas!