The Prime Minister has today set out details of his social care plan for England. From October 2023, no-one will have to pay more than £86,000 for care over their lifetime. Anyone who has assets of less than £20,000 will have their care costs fully covered by the State.

Those with assets between £20,000 and £100,000 will receive some means-tested state support.

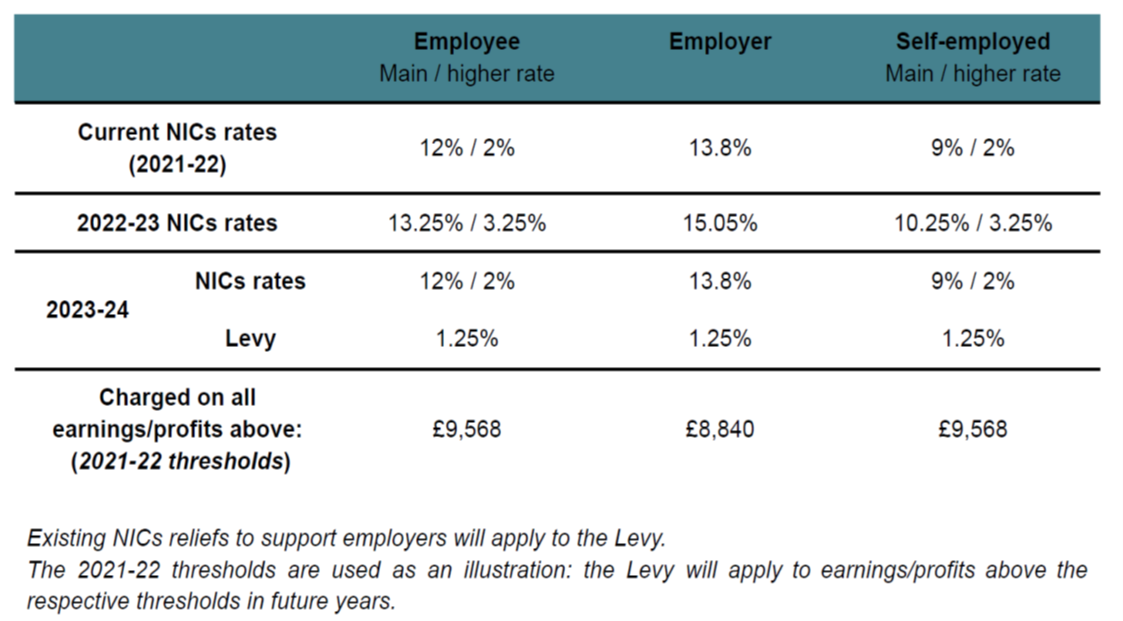

To fund the plans, National Insurance contributions will rise by 1.25% and tax on share dividends will also go up by 1.25%. The Health and Social Care Levy will apply to employees and employers liable for Class 1 NICs and self-employed individuals liable for Class 4 NICs. This is illustrated below:

The changes will come into effect from April 2022. From 2023 the NI increase will appear on people’s payslips as a separate Health & Social Care levy.

The social care changes will only apply in England, as Scotland, Wales and Northern Ireland have separate arrangements for social care. Part of the NI increase will be passed to the Scottish, Welsh and Northern Irish devolved governments.

Pensions impact

From a pension perspective, assuming there are no ‘anti-avoidance’ provisions (and none are suggested in the proposals), the increase in NICs makes salary sacrifice even more attractive in terms of the optimum way for employees to make contributions to their pension.

For example, a company has 250 employees in its money purchase pension scheme. The employees currently pay 5% of salary as a contribution, but the company decides to introduce an automatic salary exchange scheme. Consequently, the pension scheme becomes non-contributory (with the employer increasing its payments to counteract this) and members’ salaries are reduced.

The ‘before and after’ position (assuming, for simplicity, that all members earn £30,000 a year (before salary exchange); basic rate tax is payable on all taxable earnings; 2021/22 thresholds for tax/NI apply; and the proposed increase in NICs has been implemented) is as follows:

|

Before Salary Exchange |

After Salary Exchange |

|

Total Gross Salaries £30,000 x 250 = £7,500,000 |

Total Gross Salaries £28,500 x 250 = £7,125,000 |

|

Total member pension contributions £7,500,000 x 5% = £375,000 |

Total member pension contributions – Nil (but increased employer contribution) |

|

Total Personal Allowance (assume everyone gets single person allowance) £12,570 x 250 = £3,142,500 |

Total Personal Allowance (assume everyone gets single person allowance) £12,570 x 250 = £3,142,500 |

|

Total Income Tax payable [£7,500,000 – (£375,000 + 3,142,500)] x 20% = £796,500 |

Total Income Tax payable (7,125,000 – £3,142,500) x 20% = £796,500 |

|

Employee NI (£30,000 - £9,568) x 250 x 13.25% = £676,810 |

Employee NI (£28,500 - £9,568) x 250 x 13.25% = £627,122.50 |

|

Employer NI (£30,000 - £8,840) x 250 x 15.05% = £796,145 |

Employer NI (£28,500 - £8,840) x 250 x 15.05% = £739,707.50 |

|

Total take home pay £7,500,000 - £375,000 - £796,500 - £676,810 = £5,710,000 (i.e. £22,606.76 per employee) |

Total take home pay £7,125,000 - £796,500 - £567,960 = £5,760,540 (i.e. £23,042.16 per employee) |

|

|

Total NI saving (£676,810 – 627,122.50) + (£796,145 – 739,707.50) = £106,125 for one year) |

|

|

NI saving breakdown Employer saving = £56,437.50 (i.e. £225.75 per person) Employee saving = £49,687.50 (i.e. £198.75 per person) |

Ignoring the proposed increase announced today, the table would look like this:

|

Before Salary Exchange |

After Salary Exchange |

|

Total Gross Salaries £30,000 x 250 = £7,500,000 |

Total Gross Salaries £28,500 x 250 = £7,125,000 |

|

Total member pension contributions £7,500,000 x 5% = £375,000 |

Total member pension contributions Nil (but increased employer contribution) |

|

Total Personal Allowance (assume everyone gets single person allowance) £12,570 x 250 = £3,142,500 |

Total Personal Allowance (assume everyone gets single person allowance) £12,570 x 250 = £3,142,500 |

|

Total Income Tax payable [£7,500,000 – (£375,000 + 3,142,500)] x 20% = £796,500 |

Total Income Tax payable (7,125,000 – £3,142,500) x 20% = £796,500 |

|

Employee NI (£30,000 - £9,568) x 250 x 12% = £612,960 |

Employee NI (£28,500 - £9,568) x 250 x 12% = £567,960 |

|

Employer NI (£30,000 - £8,840) x 250 x 13.8% = £730,020 |

Employer NI - (£28,500 - £8,840) x 250 x 13.8% = £678,270 |

|

Total take home pay £7,500,000 - £375,000 - £796,500 - £612,960 = £5,710,000 (i.e. £22,862.16 per employee) |

Total take home pay £7,125,000 - £796,500 - £567,960 = £5,760,540 (i.e. £23,042.16 per employee) |

|

|

Total NI saving (£612,960 – 567,960 + (£730,020 – 678,270 = £96,750 for one year) |

|

|

NI saving breakdown Employer saving = £51,750 (i.e. £207 per person) Employee saving = £45,000 (i.e. £180 per person) |