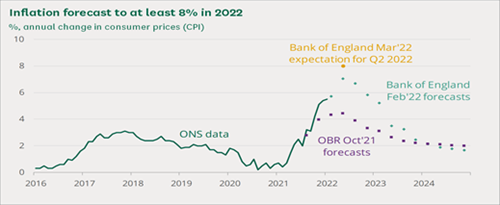

The Chancellor’s Spring Statement, which is normally a pretty straightforward update on the overall health of the economy, was always going to be dominated in 2022 by the backdrop of rising fuel, energy and food costs. Prices have risen by 6.2% in the 12 months to February[1] - the fastest for 30 years.

Source: Office for National Statistics

It does not normally include major tax or spending changes. These are made once a year at the Autumn Budget, so we weren’t expecting much on pensions – and we weren’t disappointed. However, the silver lining is perhaps that, in some ways, ‘no news is good news’, as rumours around adverse changes to the taxation of pension death benefits did not materialise.

Of the few references to pensions, there was confirmation that “efforts to reform Solvency II and the pensions charge cap to unlock institutional capital into illiquid assets are ongoing”.

The standard annual allowance will remain at £40,000. The lifetime allowance will remain at its 2020-21 level (£1,073,100) up to and including 2025-26.

One important point to note, however, relating to the increase in National Insurance Contributions from this April, is that salary sacrifice is, for most people, more than ever the most effective way to make pension scheme contributions.

Key Points

- The Chancellor began with an overview of the latest economic and fiscal outlook from Office for Budget Responsibility (OBR)[2]

- Fuel duty will be cut by 5 pence per litre for 12 months from 6pm on 23 March 2022

- For the next five years, homeowners will pay 0% VAT on energy saving materials, such as solar panels or heat pumps

- The health and care levy (increase in National Insurance Contributions), to pay for NHS and social care spending, will go ahead as previously announced. However, the government will raise the threshold people earn before they pay National Insurance. From this July, people will be able to earn £12,570 a year without paying income tax or National Insurance.

- A tax plan will be published today, with a ‘principled approach’ to cutting taxes over this Parliament. According to the Chancellor, this will first help families, then create conditions for higher growth.

- Before the end of this Parliament in 2024, “for the first time in 16 years” the basic rate of income tax will be cut from 20p to 19p in the pound.

[1] Consumer price inflation, UK - Office for National Statistics

[2] Economic and fiscal outlook - March 2022 - Office for Budget Responsibility (obr.uk)